The OECD defines Principles of Corporate Governance as:

“..a set of relationships between a company’s management, its board, its shareholders and other stakeholders. Corporate governance also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined.”

The aim of corporate governance rules is to promote transparency and fairness in its dealings with its financiers, management, employees, the government and the public generally. This in turn will impact economic performance, market integrity and promote efficiency. Corporate governance rules should be consistent with the Rule of Law and should ensure that the interests of the shareholders are being served.

In addition to the statutory laws of a jurisdiction, corporations are subject to common law in some countries, and various laws and regulations affecting business practices in their place of business and management. In most jurisdictions, corporations also have a constitution that provides individual rules that govern the corporation and authorize or constrain its decision-makers. This constitution is identified by a variety of terms; in English-speaking jurisdictions, it is usually known as the Corporate Charter or the [Memorandum and] Articles of Association, and in Liberia, the Bylaws and Articles of Incorporation. The capacity of shareholders to modify the constitution of their corporation can vary substantially.

The officer who is responsible for keeping the official records of the corporation is the Company Secretary, the official title given to the person charged with ensuring that the rules, regulations and statutory requirements of the corporation in a particular jurisdiction are adhered to and maintained.

All countries will mandate certain regulatory requirements for the maintaining of the records of a corporation and Liberia is no different. The advantage of Liberian non-resident corporations is that The Associations Law does not require any mandatory filings of Board Minutes, Share Registers, Registers of Officers and Directors, or financial information. This does not mean, however, that the Board of Directors of a non-resident Liberian corporation is exempt from this obligation. The Associations Law lays down several obligations regarding corporate governance, which, while not required to be publicly filed with the Registrar, are still required to be maintained.

There is a duty to pay annual fees (Section 1.7.2) and a penalty imposed for failure to do so.

Every Liberian corporation is required to pay an annual registration fee which is due and payable on the anniversary date of the existence of the corporation. Failure to do so will cause the corporation to fall out of goodstanding, and neither the Registrar nor the Deputy Registrar will accept filings on behalf of the corporation until it has been restored to goodstanding status. It should also be mentioned that a corporation that is not in goodstanding is denied access to courts and cannot entertain an action, suit or proceeding of any kind until it has been brought into goodstanding by payment of any outstanding annual fees.

A corporation’s Address of Record/Billing Address can request a statement of account for all of their corporations. Also, a corporation’s Address of Record can request a login to the Registry’s eCorp website so that they can check the current status of their corporations online.

There is a duty to maintain a registered agent and the penalty for failure to do so is to be found in Section 3.1 of the Associations Law.

Every Liberian corporation is required to maintain a registered agent in Liberia upon whom process against such corporation can be served. The agent for service of process for all non-resident Liberian corporations is The LISCR Trust Company at 80 Broad Street, Monrovia. Penalties for failure to maintain a registered agent are detailed in Section 11.3 of the Associations Law and include revocation of the Articles of incorporation, also referred to as Annulment or Involuntary Dissolution.

There is an obligation imposed on all corporations to hold the First Organizational Meeting. (Section 4.8)

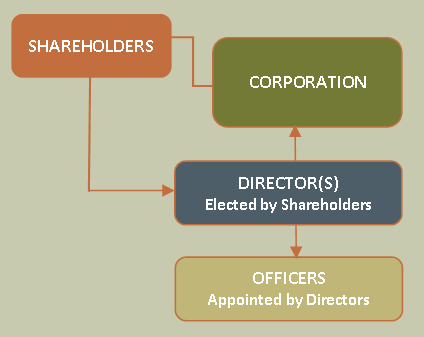

The corporation is obliged to hold an organizational meeting after the filing of the articles of incorporation. The purpose of this meeting is for the shareholders to elect directors, who in turn will appoint officers, adopt bylaws (Section 4.9) and perform any other acts required to perfect the organization of the corporation. The bylaws provide rules to guide the Officers in the internal running of the corporation. The Board of Directors are responsible for governing the corporation and answer to the shareholders, while the officers are appointed by the Board to manage the corporation on a day-to-day basis and report to the Board at specified intervals. Examples of Officer Positions are: President, Secretary and Treasurer.

The obligation to maintain a share register for all shares, whether they are registered or bearer. (Section 8.1.2)

A Register is important as it should contain information regarding the number of shares issued, date of issue and name and address of the shareholder (registered shares) or address of notice (in the case of bearer shares). The voting rights attaching to the shares may also be mentioned in the Register.

The corporation must be managed by a Board of Directors (Section 6.1) and for this a Register of Directors should be outlined in the minutes book, detailing the name, date of appointment, acceptance of appointment and date of resignation with signed resignation, wherever applicable.

Section 8.1 requires that a “book” is maintained of all meetings of shareholders, Board of Directors, designating time, place and passed resolutions. Most importantly is the requirement to hold an Annual Meeting, (Section 7.1). Alternatively, shareholders may take action without a meeting (Section 7.4).

The Board is entrusted with the election of the officers of which there must be at least two Officer positions, which can be occupied by one and the same person, who may also be a corporate or legal person, of any nationality. (Section 6.15)

A Register of Officers must also be recorded in the Minutes Book with the name and designation of the Officer, date of appointment, acceptance of the appointment and resignation date.

The keeping of books also requires that books of account be maintained in written or electronic form. Section 8.2 gives the shareholders the right to inspect an annual balance sheet and profit and loss statement for the preceding fiscal year.

When a corporation is no longer required, there is a duty to dissolve the corporation and wind up the affairs according to Sections 11.4.1, 11.4.2 and 11.5.

While Liberian Associations Law does not require that information that is kept by the company to be publicly filed, it is possible to voluntarily file any information with the Registrar in which case, a Certificate of Filing can be issued as proof to third parties as an extract from the public registry. Alternatively, it is possible to privately record information with the Registered Agent which enables the Registered Agent to issue a Certificate of Recordation but which information shall not be publicly available.

For clients’ convenience, the Corporate Registry’s regional offices offer the purchase of corporate kits and share certificates.

Please ask any of our regional offices for information regarding nominee services and other corporate secretarial services including the procuring of Liberian legal opinions.

Hilary Spilkin, Esq. TEP.

BA LLB HDip Tax LLM

Managing Director

Liberian Corporate Registry